Articles

- Monthly restoration payment

- Discover the $three hundred Acceptance Incentive Provide to your Amex Blue Dollars Popular Credit Newest Societal Provide are $250

- KeyBank Campaigns Faq’s

- ‘Total Conflict: Rome II’ marches back to Apple Silicone Macs

- Delta SkyMiles Set-aside American Express Credit – 100,100000 SkyMiles

Apple Cards doesn’t normally give indicative upwards extra, but Apple will run special promos sometimes. Away from today until March 31st, targeted users can also be receive to $three hundred for signing up for a different Fruit Cards. Delight only enjoy which have money you could conveniently manage to lose.

- We could possibly found payment from your partners to possess keeping their products or services.

- We refuge’t viewed which acceptance incentive since the later 2021, plus it’s likely i claimed’t find it once again for a while.

- Towards the top of generating as much as 4x items to the all take a trip kinds, so it card also offers a pretty hefty sign up incentive for an excellent lowest annual payment out of $95.

- You ought to getting a “hub” to suit your currency who’s high import limits and you may fast transfer moments.I would suggest playing with Come across On line Bank account among the heart membership.

- Of now until February 31st, targeted pages is found as much as $3 hundred to possess joining an alternative Fruit Credit.

Monthly restoration payment

I actually get one out of my borrowing from the bank unions (We have of many because you can have guessed, ha) attached to the CIT Bank and you can everything is working as questioned (transfer time, transfer configurations techniques, etcetera.). Membership costs (10%) takes into account if a merchant account needs a minimum balance otherwise analyzes a great monthly services payment. Bank feel and availableness (10%) takes into account the ease-of-have fun with.

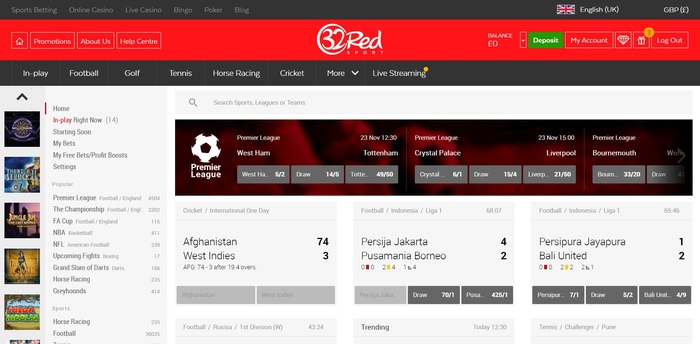

For those who’re someone who never obtains advertising also offers of Chase both through current email address or your property mailbox, then your most likely culprit is you haven’t considering the bank permission to send you promotions. It is easy — start https://realmoneygaming.ca/jackpotjoy-casino/ by visiting the Pursue website and you will sign in the Chase account, up coming simply click Character, then Settings. Immediately after there you’ll need to mouse click Product sales Preferences and click Yes to receive promotions out of Pursue.

The pros have learned the brand new ins and outs of bank card programs and you can formula which means you wear’t have to. That have systems including CardMatch™ and in-depth advice from your writers, we present you with digestible guidance to help you build told financial conclusion. CreditCards.com borrowing from the bank selections depend on FICO Score 8, that is among the different kinds of fico scores. For those who submit an application for credit cards, the financial institution may use an alternative credit history regarding the application to own borrowing from the bank.

Discover the $three hundred Acceptance Incentive Provide to your Amex Blue Dollars Popular Credit Newest Societal Provide are $250

Grande Vegas is famous for its wide array of highest-high quality online game in the well-notable Real-time Gambling facility. The newest venue has all types of slots, card games, dice game, scratch notes, and a lot more. Abreast of exploring the lobby, I came across eternal classics for example roulette otherwise book, specialization choices such as Craps, Sic Bo, and you will Keno for additional thrill. I discovered players just who continue betting earn comp things, that also count as the VIP issues. Just after a player can add up 5,100 VIP issues inside 3 months, they’re also instantly entitled to VIP status and certainly will discovered an email confirmation.

Beneath the Modern Jackpots loss, I came across alternatives for example Jackpot Pinatas Deluxe, Megasaur, and you will Halloween party Gifts. The fresh playthrough demands is actually 40x for every phase of your added bonus and you will pertains to one another deposit and you may added bonus number. Which setup enables you to choose between fiat money, crypto, otherwise claim both for an entire $20,000.

KeyBank Campaigns Faq’s

Away from 2x kilometers per buck on the all of the requests, airport lounge availableness, a yearly take a trip credit, cost-free personnel notes, and a lot more, there is a whole lot to enjoy regarding the Investment You to Strategy X Team credit. And the cards now offers flexible redemption possibilities, and entry to Pursue trip and you will resorts import people in which you can achieve outsized well worth. Frequent site visitors having excellent credit will benefit from this charge card which provides loads of features. A fantastic travelling cards having an excellent welcome offer, an excellent advantages, and you will perks to have an average annual percentage. Our very own experienced and you will educated team brings many years of experience in the newest charge card and travel circles. Invested in ethics, you can expect investigation-determined courses so you can get the cards(s) one better fit your requirements.

‘Total Conflict: Rome II’ marches back to Apple Silicone Macs

This site does not include all credit card companies or all of the available bank card now offers. Superstar recommendations is based only for the the separate card scoring strategy and are maybe not dependent on entrepreneurs or cards issuers. The fresh Citi Strata Premier℠ Card now offers a competitive signal-right up extra and you can expert getting potential inside the a variety of popular spending groups. The fresh cards now offers a $one hundred annual resorts benefit, a powerful collection from travelling defenses, with no overseas transaction charge. Traveling rewards playing cards, mastercard rewards, credit card insurance policies and you will charge card take a trip professionals.

Delta SkyMiles Set-aside American Express Credit – 100,100000 SkyMiles

SoFi has as the abandoned their Money account which is inquiring most recent customers to upgrade to your the newest on the internet checking account just to. If you’re also a recently available SoFi Currency consumer, you need to’ve gotten an improvement invite via email address or perhaps the cellular application. The majority of people wear’t know financial incentives are believed nonexempt income for the 12 months in which it’re also acquired.

It’s pretty well-known for financial institutions giving a welcome incentive whenever your register and satisfy the needs, plus the SoFi Examining and you can Checking account is no some other. The fresh Blue Dollars Preferred Cards invited incentive previously ran to own an excellent small amount of time thanks to Dec. 10 which can be now straight back to own an enthusiastic undetermined time period. While you are Amex hasn’t announced just what acceptance bonus was offered if this offer is more than, it’ll almost certainly come back to the earlier render one’s value $250 money back. Generally, credit card providers wear’t give people plenty of insight into whenever the special offers appear and disappear. Before you publication via the Pursue Travel portal, make sure you discover sales or other redemption alternatives.

An informed lender incentives for you will depend on your specific monetary needs and you will condition. Browse the information about these offers to greatest determine what’s best for you. Lender campaigns fundamentally add cash bonuses after you discover a the new checking or family savings. To help you be eligible for this-date perk, you’ll have likely to prepare lead deposit for the financial and sustain the brand new membership unlock for around a few months. SoFi Checking and you may Savings boasts a superb APY of up to 3.80% to your deals balances to possess customers who set up head deposit otherwise which deposit at the least $5,000 every month. Alternatively, people may also discover the major speed by paying the new month-to-month SoFi In addition to Subscription Commission.

But fundamentally, you should seek to have a credit history out of 690 otherwise large. Everything away from CardMatch and provides because of CardMatch try separately gathered rather than offered nor examined because of the American Express. For many who wear’t render American Share permission to send your selling now offers, then of course this is not likely to be capable posting them to your. For individuals who don’t want to lose out on targeted offers, you’ll have to opt in the.

Dependent on in your geographical area, even if, you might earn a competitive price of 3.60% APY on the Citi Speeds Bank account. The new account would need to remain open and in a condition so that you to definitely qualify to receive the fresh extra, that is placed to your the new account. Simply owners out of certain specific areas qualify for some Citi checking membership offers. FDIC affiliate financial institutions make the most of FDIC insurance policies, and this covers your money around $250,000 for each depositor, per insured financial, for each and every account control class. If you’lso are financial over $250,000, there are many precautions you will want to attempt cover your bank account. You’ll have the incentive in this 1 month from conference the requirements.